Delivery Driver Flex Expenses 2020 takes a fresh look at the typical costs associated with being an Amazon Flex delivery driver. If you are starting out as a driver in the parcel delivery industry, it is important to focus on how much you keep from what you earn. The money you have time to earn must meet and surpass the expenses you generate. When earnings are higher than expenses you have surpassed your breakeven point and begin making a profit. At the end of the day, if it cost you more to drive than you make, you will have a short-lived entrepreneurial experience.

Delivery Driver Expenses for Flex Drivers in 2020

Expenses for delivery drivers are important to monitor and record as they are deducted from your total income for tax purposes. Currently, delivery drivers are considered independent contractors, and therefore responsible for their own business operating expenses. A part of submitting local and federal income tax forms will require documentation of all business write-offs.

Delivery Driver Expense Tips 2020

The key categories of expenses allowable for Delivery

Driver Expenses in 2020 are the expenses for the operation of the vehicle and

the expenses for the operation of the business.

Delivery Driver Flex Expenses 2020 for the Operation of the Vehicle

- Car/Van Loan or Car Rental costs – A portion of the monthly vehicle loan or lease payments may be expensed against income. The percentage amount will be determined by the recorded mileage used for business use compared to the total distance traveled each year. Car rentals and car rental costs may be proportioned, depending on the amount for delivery distance used.

- Licensing – Annual License Plate Renewal Fee is a vehicle expense. (Watch for fees to rise for non-personal use of a licensed vehicle)

- Registration/Inspection & Repair Costs – Preparing a car to qualify for delivery service may require some expense. Inspection for safety may also be required for startup.

- Insurance – The cost of insurance will require a percentage of personal to business kilometers or miles driven to be a permissible expense. To verify local state or provincial regulations, contact a qualified accountant or online representative.

- Maintenance – Including oil change, car washes, window washer fluid, wiper blades, mechanical and body repairs.

- Fuel – Fuel, gas and diesel, and fuel additives will be the largest recurring vehicle running cost. Fuel credit and discount cards are vital to minimizing expenses.

- Tolls – Tolls are common delivery vehicle expense items. Transponders may provide recorded history for tax deductions.

Delivery Driver Business Operating Expenses

- Mobile Phone – The cost of purchasing a mobile phone and cell phone plans are required expenses for delivery drivers. However, separating personal and business use is necessary to expense a business portion. To easily separate and allocate costs, use a dedicated phone for business. Remember to include additional app costs for mileage trackers.

- Internet Access – A home office internet expense is a cost of doing business. Confirm with your local accounting firm or online adviser the allowable percentages.

- Home Office Space – Home office space description and allowances are regulated for income tax purposes. Square floorspace dimensions typically define the area and percentage applied to rent, power, and insurance. The area must be dedicated only to business with a door entrance.

- Office Expense – Postage The cost of paper communication for business purposes is a deductible expense of operating as a delivery driver. Mailing forms and fax transmissions costs should be captured for a tax deduction.

- Professional Expense – The cost of tax preparation and legal fees to establish a business are considered expenses for tax purposes.

- Meals During Work Hours – Meals taken during work hours may be a questionable expense for delivery drivers. Meals, where business matters are discussed, may be permissible if you add to the back of the receipt the reason for the meeting and the name of the person sharing the meal. The distance from your domicile is one measurement for allowance for meals out of town. Clarify with a local accounting firm or online adviser on eligible expenses.

- Home Insurance – Home and rental insurance are expenses for a home office. Typically, the percentages used for an office space apply to insurance costs.

- Bank Fees – (Monthly Acct Fees, Deposit Fees) – Credit Card, and Fuel Card Fees, and Reimbursements Bank fees and credit card annual fees are a cost of doing business. Allocate a credit card and fuel card exclusively for business for easy record keeping.

- Employment Tax – Self-employed delivery drivers are responsible for employment taxes to be remitted in the US. Canadians remit annual taxes.

- Training & Education Some online training and educational costs relevant to increasing delivery driver knowledge and earnings may be business operational costs under office expense. Consult a specialist.

Tracking Delivery Driver Expenses

Before getting overwhelmed with tracking delivery driver expenses, or making costly mistakes that take time and money, let me help simplify the process and keep you on track to make money in 2020.

Delivery Driver Kilometer & Mileage Tracking for 2020

A key measurement required for delivery driver expenses is

the distance driven for business. Keeping track of mileage or kilometers is

essential to identifying personal use versus rideshare use of a vehicle and

therefore the expenses allotted.

The distance from and to your home and business-related

mileage should be recorded for deduction purposes. Consult government

guidelines or a qualified accountant for allowable expense percentages for each

expense category.

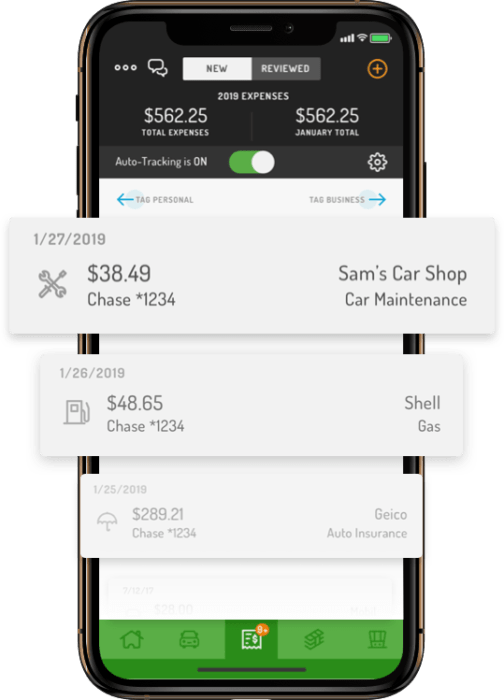

Tracking apps are used to record business kilometers or

miles for business tax deductions on your vehicle. Some apps may simply

document the mileage, leaving you to apply appropriately to your tax return.

Others will integrate with accounting programs like QuickBooks.

Any tracking app should include all operating costs for the vehicle and the separate operating costs for business administration. My preference is to minimize clicks and have one entry integrate directly to the tax return line item. It saves time and money. The vehicle operating costs tracked should include:

- Car Loan or Car Rental costs, including interest

- Vehicle registration and annual license plate fees

- Fuel

- Repairs & Maintenance

- Insurance

- Tolls

https://www.hurdlr.com/

Tracking Apps for Delivery Driver Expenses

For tax purposes, there are additional administrative costs of business that need to be itemized, categorized, and allocated properly.

- Health Insurance

- Bank, (Monthly & Deposit Fees) Credit Card, and Fuel Card Fees, and Reimbursements

- Employment/Government Remittances & Tax Obligation

- Mobile Phone – Dedicated to Business

- Home Office

- Internet Access

- Office Space Expense by Square Dimension as a Percent

- Office Expense – Postage

- Advertising/Marketing

- Meals During Work Hours

- Home Insurance

- Training & Education

- Tax Preparation

Rapidgo Driver Top Distance Tracking App Picks 2020.

- QuickBooks

Self-Employed - Hurdlr

- Stride Drive

- Everlance

- SherpaShare Mileage/Expense Tracker

- MileWiz

- Easy Logbook

- TrackMyDrive

- MileIQ

- TripLog

- TaxMileage

- FYI Mileage

- MileBug

Disclaimer and advice. Provincial and federal

Canadian tax regulations change often. The cost of using an accounting firm or online

tax return service is a business expense, which lowers the taxable income on a

driver’s earnings. It is always safer to consult an expert.

Speak to a qualified local accountant or online expert during your startup phase of beginning a delivery driver side-gig. They will provide valuable guidance on the proportionately of each expense allowed by local territory laws.

Understanding Delivery Driver Expenses 2020

Business expenses are not as complicated as they may appear. Once the purpose is understood, it is a matter of filling in the blanks as quickly and easily as possible and learning how and where to improve the profit outcome. Knowing about these expenses is important.

Incorporation as a Flex driver business in 2020

Typically, there is not a requirement for Flex drivers to create a formal business registration. However, depending on your personal needs, or future goals, you may require help setting up a corporation. My personal experience with LegalZoom has been exemplary. They keep things simple, easy to understand, and follow-up.

Conclusions & Outtakes

Delivery Driver Flex Expenses 2020 takes a fresh look at tracking expenses as a requirement for Flex drivers as independent contractors. The two key areas to monitor costs are vehicle expenses and business operating expenses. Knowing where the money is being spent generates a focus on means to reduce expenses while increasing earnings. Sign up for the Rapidgo Driver News and stay on top of topics impacting delivery drivers.

To expand into the food and pickup gig economy, get all the

tips & tricks HERE.

If you want to increase your income read THIS.

Let us know if this is helpful information and leave a

comment. We will get back to you. Thanks!