Cloud kitchen market analysis for last-mile mobility looks at apps to increase profits. A cloud kitchen—also referred to as a “ghost kitchen” or “virtual kitchen”—is a commercial kitchen space that provides food businesses the facilities and services needed to prepare menu items for delivery and takeout. Unlike traditional brick-and-mortar locations, cloud kitchens allow food businesses to create and deliver food products with minimal overhead. Recent data indicates that meal delivery orders increased by more than 150% from 2019 to 2020—and UBS anticipates the food delivery market to increase more than 10x over a ten-year period. More and more restaurant owners and food entrepreneurs are turning to cloud kitchens as an ideal business solution to capture this increase in food delivery demand. The current concept of the cloud kitchen initially emerged in India. In 2003, Rebel Foods, backed by Sequoia, started its first business, Faasos, which sells Kebabs. Today, Rebel Foods has over 9 brands and recently raised $125 million and is valued at $525 million.

The rise in COVID-19 cases globally made social distancing imperative. Moreover, frequent lockdowns to contain the spread of the virus acted as a catalyst in increasing the demand for deliveries and takeaways, leading to a rise in the number of cloud kitchens globally. Restaurants facing a slump in business due to declining footfall have shifted to the virtual kitchen concept, as the takeaways model emerged as a viable source of generating revenue during the COVID-19 pandemic. Furthermore, as virtual kitchens require minimal investment and operational costs to run, they help restaurants improve their profit margins. The increased realization of the benefits of cloud kitchens is encouraging several food entrepreneurs and restaurateurs to invest in cloud kitchens.

Before the global pandemic hit the world in 2020, at least 70% of the restaurant’s business was attributed to the dine-in segment, while about 30% were deliveries. There were restaurants that relied wholly on the dine-in option, like restaurants in hotels, etc. However, the Coronavirus changed it all. Suddenly, that 70% of the F&B business vanished, and restaurant owners had major business restructuring choices to make, or else close their business. The story was the same throughout the world, and it was no different in the USA.

After the initial rush, it is likely that the pandemic changed the dining habits of the US people permanently. 1 in 6 U.S. restaurants has been forced to close since the start of the pandemic, the National Restaurant Association said in December. Consumers’ embrace of food delivery could relegate even more dining-out experiences to consumers’ own dining rooms.

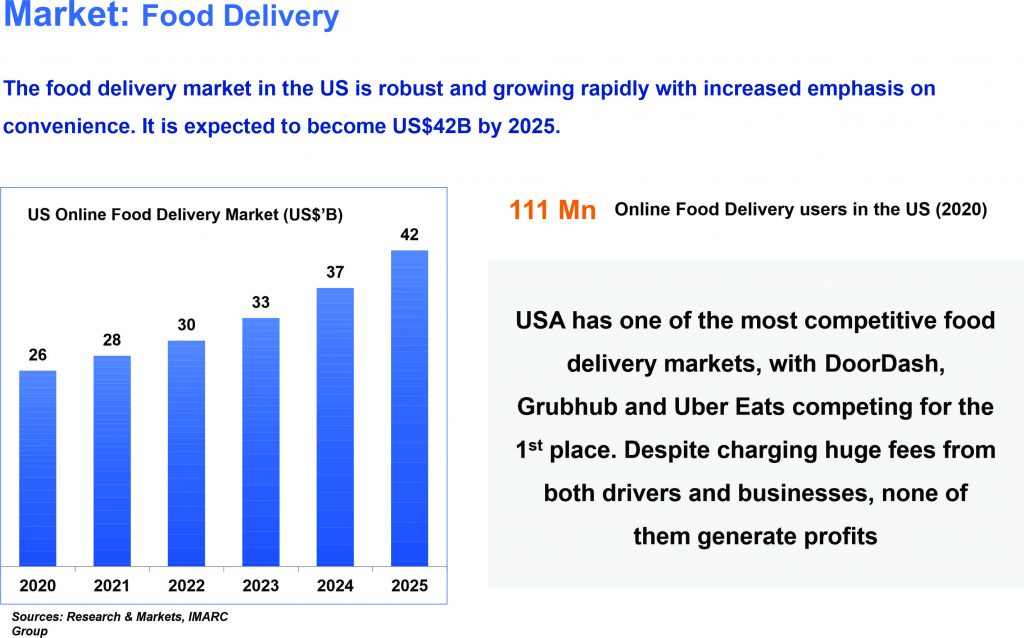

The Cloud kitchen market analysis describes how the most important role in the advent of cloud kitchens has been played by food aggregators. With services like UberEats, DoorDash, PostMates, Deliveroo, Eat24, Amazon Restaurants, Swiggy, etc., food has become available through just a few clicks. These services charge between 15% and 35% to restaurants as commission. Ideally, restaurants don’t mind the commission due to the order volumes generated by these services. Cloud kitchens are commercial facilities purpose-built to produce food specifically for delivery. They do not have brick-and-mortar dine-in areas and consist of shared kitchen space with culinary staff preparing meals that are then delivered to customers at home or at work, typically through online delivery companies such as Uber Eats, Postmates, Grubhub, and DoorDash. (Delivery services are not new, of course.

For more cloud kitchen market analysis solutions look to Rapidgo Driver apps for Last-Mile Mobility HERE.

Learn about Food Truck market analysis HERE.